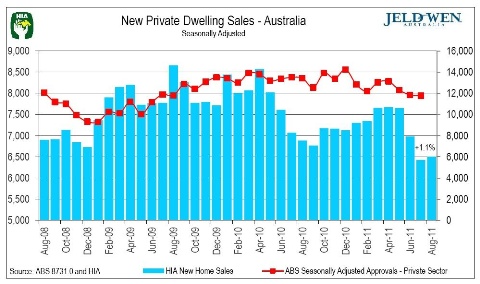

New home sales have remained at 10-year lows for consecutive months, a survey of Australia's major residential builders has shown, signalling tough times ahead in the residential sector.

The latest HIA - JELD-WEN New Home Sales Report showed that the number of new homes sold in August 2011 edged up by 1.1 per cent in August following declines of 8 per cent in July and 8.7 per cent in June.

Detached house sales increased by 1.5 per cent in the month of August 2011, but were down by 15 per cent over the August 'quarter'. Sales of multi-units fell by 2.2 per cent in August.

"New housing conditions are very soft at present," said HIA chief economist Dr Harley Dale. "For those who are in a financially capable situation to build a home, now is a very good time to contemplate doing so."

"There is unwillingness on the part of households to commit given the uncertain domestic and global economic conditions which currently prevail, and that is understandable.

“That's where interest rate cuts and fiscal stimulus can play an important role in boosting new housing supply in a very competitive market, which in turn would have a positive multiplier effect in bolstering the wider domestic economy,” he said.

"The improvement in the volume of detached house sales in August reflected a bounce of 9.8 per cent in Queensland and a rise of 3 per cent in Victoria," said Harley Dale.

"August marked the first month of the Queensland Government's Building Boost Grant and this has clearly had a positive, if modest impact on sales."

Detached house sales fell in the remaining three mainland states, dropping by 5.8 per cent in New South Wales, 4.7 per cent in South Australia, and 0.7 per cent in Western Australia.??

Meanwhile, a new National Australia Bank Property Index showed house prices fell for a second consecutive quarter and are expected to continue to decline as housing affordability issues escalate.

Respondents to the NAB survey said access to credit was now the biggest impediment to buying a property.

NAB chief economist Alan Oster said in the Herald Sun that housing affordability had replaced rising interest rates as the next biggest constraint on new property developments.